Understanding Your 2018 Tax Liability: A Comprehensive Guide

The 2018 tax year marked a significant shift in the United States tax landscape with the implementation of the Tax Cuts and Jobs Act (TCJA). This legislation introduced the most sweeping changes to the tax code in decades, affecting everything from tax brackets and standard deductions to personal exemptions and itemized deductions. Whether you are filing an amended return, conducting a historical financial analysis, or simply trying to understand your past tax liability, our 2018 Tax Calculator is designed to provide you with accurate estimates based on these specific rules.

Navigating the complexities of the 2018 tax code can be challenging, especially given the elimination of personal exemptions and the near-doubling of the standard deduction. This guide will walk you through the key changes, help you understand how the 2018 tax brackets work, and explain how to use our calculator to determine your liability or potential refund.

Key Changes in the 2018 Tax Year

The Tax Cuts and Jobs Act brought about several fundamental changes that distinctively separated the 2018 tax year from its predecessors. Understanding these changes is crucial for accurate calculation.

- New Tax Brackets: The law retained seven tax brackets but lowered the rates for most income levels. The top rate dropped from 39.6% to 37%.

- Increased Standard Deduction: The standard deduction was nearly doubled for all filing statuses, significantly reducing the number of taxpayers who needed to itemize.

- Elimination of Personal Exemptions: The $4,050 personal exemption for yourself, your spouse, and each dependent was suspended.

- Expanded Child Tax Credit: The credit was doubled to $2,000 per qualifying child, with a higher income phase-out threshold.

- SALT Deduction Cap: The deduction for State and Local Taxes (SALT) was capped at $10,000 combined for income, sales, and property taxes. This was a major point of contention for residents of high-tax states like New York, New Jersey, and California. Previously, taxpayers could deduct an unlimited amount of these taxes.

Additional Taxes for High Earners

While the TCJA lowered income tax rates, high-income earners in 2018 still faced additional levies that had been introduced by the Affordable Care Act. It's important to include these in your calculations if you fall into the applicable income ranges.

Net Investment Income Tax (NIIT)

Taxpayers with significant investment income faced a 3.8% tax on the lesser of their net investment income or the amount by which their modified adjusted gross income (MAGI) exceeded the statutory threshold. For 2018, these thresholds were:

- $250,000 for Married Filing Jointly

- $200,000 for Single or Head of Household

- $125,000 for Married Filing Separately

Investment income includes interest, dividends, capital gains, rental and royalty income, and non-qualified annuities. This tax is in addition to regular income tax or capital gains tax.

Additional Medicare Tax

A 0.9% Additional Medicare Tax applied to wages, compensation, and self-employment income exceeding the same thresholds listed above ($200,000 for singles, $250,000 for couples). Employers were required to withhold this tax from paychecks once wages exceeded $200,000, but if you had multiple jobs or a spouse with income, you might have owed more when filing your return.

The Qualified Business Income (QBI) Deduction

Another headline feature of the 2018 tax code was the introduction of the Section 199A deduction, commonly known as the QBI deduction. This allowed many sole proprietors, partnerships, S-corps, and sometimes trusts and estates to deduct up to 20% of their qualified business income from their taxes.

However, the deduction came with a complex set of rules and limitations, particularly for "Specified Service Trades or Businesses" (SSTB) like health, law, consulting, and athletics. For 2018, the full deduction was generally available if taxable income was below $157,500 (single) or $315,000 (joint). Above these levels, the deduction began to phase out or become subject to wage and capital limitations.

Our calculator provides a simplified estimate, but calculating the precise QBI deduction often requires professional tax software due to the interplay of W-2 wages and unadjusted basis of assets.

2018 Federal Income Tax Brackets

One of the most critical components of your tax calculation is understanding which tax bracket your income falls into. The United States uses a progressive tax system, meaning your income is taxed at different rates as it rises. For 2018, the tax rates were 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Here is a breakdown of the 2018 tax brackets by filing status:

Single Filers

- 10%: Income between $0 and $9,525

- 12%: Income between $9,526 and $38,700

- 22%: Income between $38,701 and $82,500

- 24%: Income between $82,501 and $157,500

- 32%: Income between $157,501 and $200,000

- 35%: Income between $200,001 and $500,000

- 37%: Income over $500,000

Married Filing Jointly

- 10%: Income between $0 and $19,050

- 12%: Income between $19,051 and $77,400

- 22%: Income between $77,401 and $165,000

- 24%: Income between $165,001 and $315,000

- 32%: Income between $315,001 and $400,000

- 35%: Income between $400,001 and $600,000

- 37%: Income over $600,000

The 2018 Standard Deduction

For many taxpayers, the most impactful change in 2018 was the increase in the standard deduction. This amount is subtracted from your gross income to determine your taxable income. If your itemized deductions (such as mortgage interest, charitable contributions, and state taxes) did not exceed the new standard deduction limits, it was generally more beneficial to take the standard deduction.

| Filing Status | 2018 Standard Deduction |

|---|---|

| Single | $12,000 |

| Married Filing Jointly | $24,000 |

| Head of Household | $18,000 |

| Married Filing Separately | $12,000 |

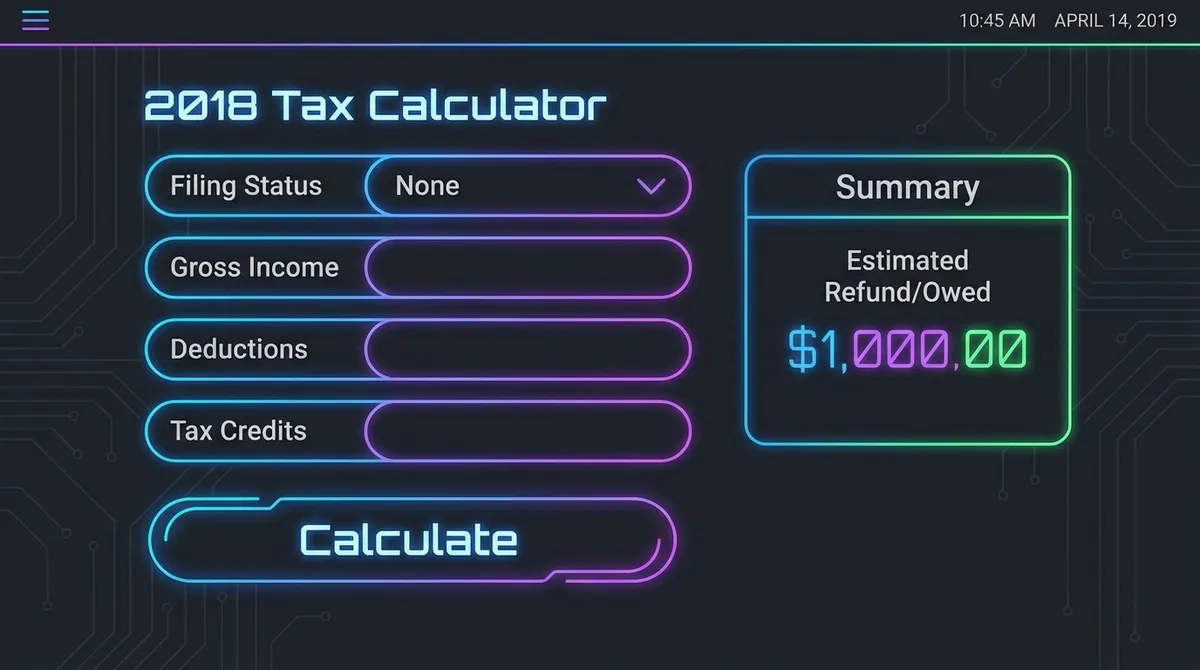

How to Use This Calculator

Our 2018 Tax Calculator is designed to be user-friendly while handling the specific logic of the 2018 tax code. Follow these steps to get your estimate:

- Select Your Filing Status: Choose whether you filed as Single, Married Filing Jointly, Married Filing Separately, or Head of Household. This determines your standard deduction and tax brackets.

- Enter Gross Income: Input your total income for the 2018 tax year. This includes wages, salaries, tips, and other taxable income.

- Enter Taxes Paid: Input the total amount of federal income tax withheld from your paychecks or paid via estimated tax payments. This is found on your W-2 (Box 2) or 1099 forms.

- Deductions (Optional): If you itemized your deductions in 2018 (e.g., Schedule A), enter the total amount. If you leave this blank or enter an amount lower than the standard deduction, the calculator will automatically apply the standard deduction for your filing status.

- Tax Credits: Enter any tax credits you were eligible for, such as the Child Tax Credit ($2,000 per child in 2018) or education credits. Credits reduce your tax liability dollar-for-dollar.

- Calculate: Click the button to see your estimated tax liability, effective tax rate, and whether you would have owed taxes or received a refund.

Common Scenarios for Using a 2018 Tax Calculator

Why would you need to calculate taxes for a year that has already passed? There are several common reasons:

- Filing an Amended Return (Form 1040-X): If you discovered an error on your original 2018 return or received a corrected tax document, you may need to file an amendment. You generally have three years from the original filing deadline to claim a refund.

- Filing a Late Return: If you missed filing your 2018 taxes, it is crucial to file as soon as possible to minimize failure-to-file penalties, although the window to claim a refund may have closed.

- IRS Notices: If you received a notice from the IRS proposing changes to your 2018 return (CP2000), you can use this calculator to verify their figures against your own records.

- Historical Analysis: Comparing your tax burden across different years can help you understand how changes in income or tax law affect your finances over time.

Pro Tips for 2018 Tax Returns

Even though the 2018 tax year is behind us, keeping these tips in mind can help if you are dealing with past tax issues:

- Check the Refund Statute of Limitations: The IRS generally allows you to claim a refund for up to three years after the return due date. For 2018 returns, the deadline was typically April 15, 2022 (or later if extensions applied). Be aware that this window may have closed for many taxpayers.

- Review Your Withholding: The 2018 changes caused many people to be under-withheld, leading to surprise tax bills. Use this calculator to see if your withholding was sufficient.

- Don't Forget State Taxes: This calculator estimates federal tax liability. Your state likely has its own tax brackets and rules, which may or may not conform to the federal TCJA changes.

For more information on current tax rates, check out our 2024 Tax Calculator to see how the laws have evolved. If you need to look up other years, visit our Year-by-Year Tax Calculators section.

For official guidance and forms related to the 2018 tax year, you can visit the IRS Prior Year Forms and Publications page. Additionally, the Tax Foundation offers excellent historical data on tax brackets.